On March 16, 2020, 29 organizations representing the interests of people with arrest and conviction records submitted comprehensive comments and recommendations to the Federal Deposit Insurance Corporation (“FDIC”) in response to proposed regulations (84 Fed. Reg. 68353, dated December 16, 2019) governing criminal record background checks under Section 19 of the Federal Deposit Insurance Act (“FDI Act”). On July 24, 2020, the FDIC Board released final regulations, which included the following provisions and commentary responding to the joint recommendations of the advocacy organizations (the regulations take effect 30 days after they are published in the Federal Register):

- Of special note, the final rule adopted the recommendation of the advocacy organizations to preclude consideration of all expunged records thus removing the “complete” expungement requirement, which excluded expungements that allowed certain entities to access the record for employment purposes.

- While far more limited than the recommendations of the advocacy organizations, the final regulations expanded the de minimis offenses (i.e., offenses for which approval is automatically granted and no application is required) as follows:

- Includes up to two de minimis covered offenses, rather than just one.

- Eliminates the waiting period when a single covered offense would be considered de minimis.

- Decreases the waiting period for the second covered offense from 5 years after conviction or pretrial diversion program entry to 3 years; and decreases the waiting period for individuals who were 21 years or younger at the time of the underlying misconduct, from 30 months to 18 months.

- Increases the small-dollar theft threshold from $500 to $1,000.

- Includes as a de minimis offense the use of a false identification to circumvent age-based restrictions.

- The final regulations declined to adopt the advocate recommendations to eliminate the “jail-time” rule, raise the bad-check threshold, recognize more lesser offenses, and expand the youth exception.

- Of special concern, the FDIC declined to adopt the following recommendations of the advocacy organizations in its final regulations:

- More narrowly define “dishonesty” offenses and limit consideration of drug offenses and “pretrial diversion” programs.

- Adopt reasonable “washout” periods limiting consideration of older offenses.

- Streamline the application process to expand the take-up rate, liberalize the conditions that govern employer-sponsored applications, and expand the criteria that govern the rehabilitation determination.

Download the policy brief for full recommendations.

Related to

Related Resources

All resourcesTerrance Hampton, Beyond the Bars

Worker Voices

Letter in Support of AB 248, Fair Wages for Incarcerated Workers in California

Comments & Letters

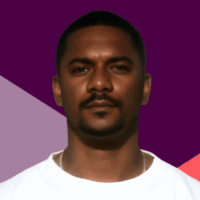

Donta Brown, Formerly Incarcerated Worker and Organizer

Worker Voices